What is Cross Collateralization?

Cross collateralization is the act of using multiple assets to secure one loan.

Who Qualifies for Cross Collateralization Deals?

Investment property owners with high equity in an investment property or own a piece of investment real estate free and clear (no debt).

Why Do Real Estate Investors Use Cross Collateral?

Cross-collateralization loans allow real estate investors to utilize equity in their real estate investment properties without having to refinance their long-term debt or take out long-term debt altogether.

How Do Real Estate Investors Use Cross Collateral?

Cross collateral is most commonly used in lieu of a down payment to give real estate investors 100% financing on new acquisitions (fix-and-flips or buy-and-holds).

Does my property need to be owned free and clear to be used as cross collateral?

No! If you have high equity in your existing real estate property and there is a low balance first mortgage, you can use equity in that property as a form of down payment for a hard money loan. This allows you to significantly reduce your down payment or obtain 100% financing.

How Are Cross Collateralization Loans Repaid?

Two ways. The first is through the sale of one of the properties collateralized against the loan. It is a very common use case that borrowers (clients) will use equity in another property they own to get 100% financing on a fix and flip. Once the fix and flip is complete, our loan is paid off at the sale of the fix and flip. If you are holding the property as a rental, then the loan would be paid off with the refinance proceeds for the new long-term loan on the rental.

What Are the Additional Risks of Cross Collateralization?

Cross collateralization involves pledging additional collateral to the performance of another loan. If the loan does not perform, then both properties can be used to recoup proceeds to repay the loan through a foreclosure sale.

What Are the Benefits of Cross Collateralization?

Cross collateralization is a terrific way to use existing equity in a property to help you get into new real estate deals with little cash. This allows you to scale your portfolio using both equity and cash. This has become an increasingly popular creative financing option as real estate investors have low interest mortgages, which they prefer to keep, but still want the flexibility of a cash out refinance to tap into their existing equity in order to scale their real estate investment business.

Real Case Study: Hard Money Loan WITH Cross Collateral.

Our client purchased this single-family property in Middletown, OH (the photo is after renovation).

Instead of our borrower bringing 20% in the form of a down payment, they instead pledged another single-family rental property they owned as collateral for the deal.

The property was valued at approximately $100,000 and was owned without any existing liens or mortgages so we were more than comfortable using that property’s equity in lieu of a down payment.

So how did it change the structure of the loan?

We wrote one note, secured by the two properties – the newly acquired flip and the currently owned rental. Instead of requiring $32,000 down, we funded 100% of the deal, which means the borrower just had to cover closing costs.

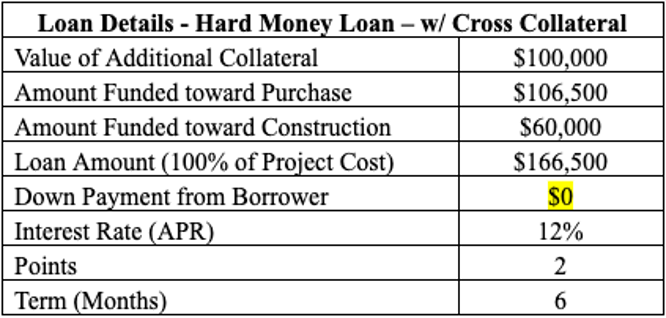

Here are the full loan details:

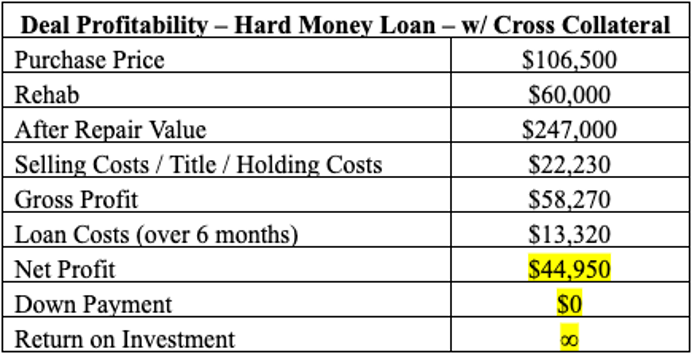

What about the profitability of the deal?

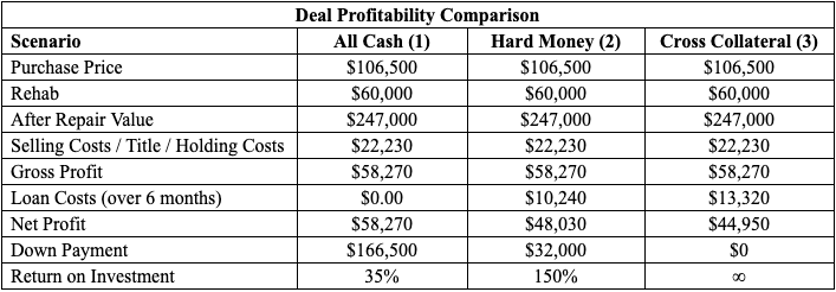

Here is the deal profitability across three different scenarios. Scenario 1 is if the borrower did the deal with all cash. Scenario 2 is if the borrower did a hard money loan without cross collateralization. And scenario three is cross collateralization scenario (100% financing).

The key benefit of cross collateralization is that it reduces the cash out of pocket for the client (borrower), which increases the return on investment. Cross collateralization is a terrific way to steadily grow your real estate investment business by utilizing equity in properties you already have.

Want to learn more about using cross-collateralization to scale your real estate investment business?

Just reach out!

Chris & Grant

Sharper Capital Partners

Local Hard Money Lenders

Phone: 513-401-5143

Email: info@sharpercapital.com

www.sharpercapital.com